As we continue the transition into an increasingly paper-free existence, eStatements have become the statement of choice for industries across several verticals. According to the Consumer Financial Protection Bureau, 56% of credit card holders received only eStatements in 2020, up from about 25% in 2014.

eStatements are commonly used as digital bills and invoices in the banking, healthcare, insurance, telecommunications, and utilities industries, and they continue to grow in popularity among both providers and consumers.

eStatements contain the same information as a traditional paper statement or customer invoice but are available more readily through app, mobile, or web access. Increasingly, both industries and customers are transitioning away from paper statements and toward digital eStatements because they present several unique and appealing advantages and benefits to their customers. Conversely, paper statements continue to fall out of favor. According to Business Insider, some companies are going so far as to charge a paper statement fee for those customers who still receive physical copies of their statements.

Within the realm of financial services, Citibank is taking things one step further. The banking giant, which has been automatically enrolling new customers in eStatements, recently informed its credit card and retail banking customers who bank online but still receive paper statements that if they choose not to convert to paperless, they will lose all digital access. Any Citibank customer who opts for paper statements will no longer be able to use their web, mobile, or app until they agree to receive eStatements.

This is the latest effort in Citibank’s years-long push for an all-digital operation, which they say saves their business money, benefits the environment, and enhances customer flexibility through new digital features that Citibank pays for with the savings of paperless operation.

While Citi’s strategy may seem extreme, they are correct in their assessment of the wide range of advantages and benefits eStatements offer. With that in mind, let’s take a deeper look at the benefits of eStatements, as well as effective eStatement adoption strategies for businesses that currently rely on paper statements and invoices.

Jump To:

Benefits of eStatements

As a provider, transitioning from paper to eStatements streamlines communication, improves access, offers potential savings, and promotes environmental sustainability. Customers will benefit from convenience, safe and timely information access, and a reduced carbon footprint.

Easier to access

Customers are increasingly appreciative of the ease of access online services provide, allowing them to take matters into their own hands, rather than relying on an outside party. According to Hubspot, 73% of customers value a site’s ability to resolve matters using self-service. When it comes to eStatements, as long as your customers have an internet connection, they can instantly view their statements and pay their bills. They no longer need to rely on a paper statement to view their account information.

Safer for customers

eStatements are digitally encrypted to protect customers’ sensitive accounts and personal information. Going paperless eliminates the possibility of a paper statement or bill (and a customer’s valuable personal information) ending up in the wrong hands, either as a result of theft or misplacement. With mail theft increasing by 48% year-over-year in 2023, going paperless ensures that customers can safely view their account information at their leisure in the environments of their choosing.

Better for the environment

Paper statements and bills are often multiple pages long. Adopting eStatements in place of paper is environmentally friendly, and reduces the carbon footprint of everyone involved.

Savings for your business

Postal rates and printing costs are consistently rising. According to data from the USPS, the price of domestic postage has increased by 40% since 2016, and a survey conducted that same year by CreditCards.com found that an estimated 93 million consumers still received their credit card statements in paper form.

Fewer paper statements mean less money spent on paper, printing, and mailing. When you add to the amount of time that employees may spend searching for or recreating lost documents, the writing is on the wall: Going paperless can offer savings opportunities and extend valuable resources.

eStatement Adoption Strategies for Businesses

Knowing the benefits of eStatements for businesses as well as customers, what types of paperless adoption strategies will make the most sense for your business?

#1. Educate

To get everyone on board with a paperless statement strategy, customers and employees need to understand why eStatements are beneficial and why they’re a better choice than paper statements and bills. By educating both internal and external stakeholders, you can create a company-wide culture of change and paint a clear picture of the logic behind adopting eStatements.

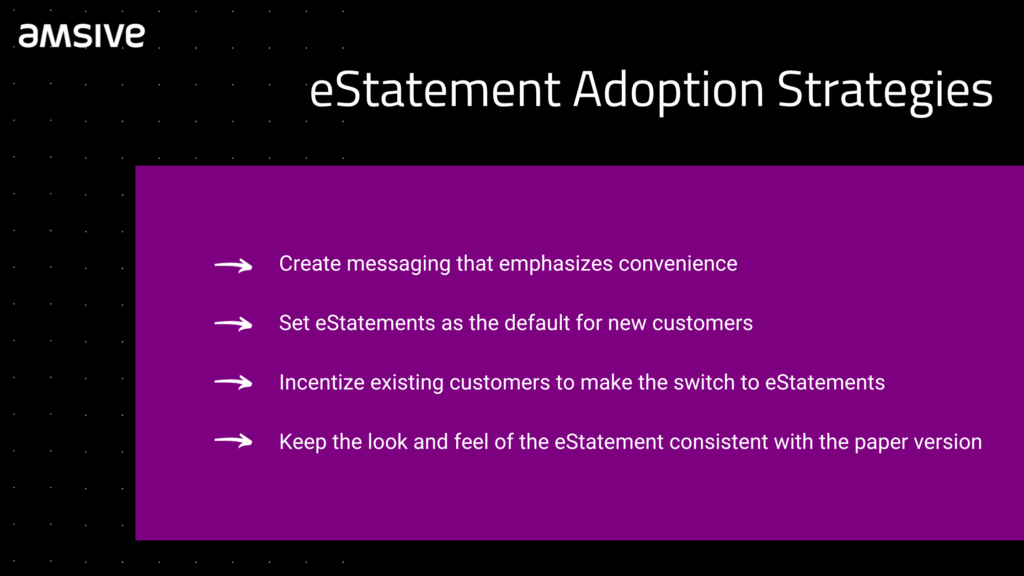

#2. Emphasize Convenience

The easier it is for customers to opt into paperless statements, the more likely they are to follow through on switching. Offer the ability to opt-in when a new customer signs up for services for a seamless experience. But also ensure the process of signing up is simple by allowing forms to be completed online at any time.

You can meet your customers no matter where they are through convenient sign-up entry points via mobile, desktop, phone, or even in person. Equally important, however, is promoting the convenience of using paperless statements and bills to customers. By highlighting the ability to easily search for, store, and pay bills online, the idea of going paperless is more likely to resonate with potential users.

#3. Incentivize

Make it worth the customer’s while to opt into eStatements. Incentivize the action with reward points that can be accumulated and redeemed for a product or service, or an entry into a prize drawing.

#4. Advertise

By consistently putting the paperless option—and its benefits and incentives—in front of customers, your business increases the likelihood of eStatement adoption. If they sign up in person, create marketing materials to display in brick-and-mortar locations.

For the customers still receiving paper statements, include an attractive piece of direct mail collateral with their statement to sell the benefits of switching to eStatements. And, most importantly, get your message to them through a variety of digital channels.

- Email: Develop email campaigns for current customers to encourage eStatement use. You could also create a campaign exclusively targeting customers who still receive paper statements and invoices. For your new customer email campaigns, be sure to promote eStatements in your initial contact.

- Website: Along with your billing portal, your company website should feature prominent messaging related to eStatements. Consider ads, pop-ups, and even search-optimized content that promotes the benefits of paperless statements and invoices.

- Paid Search Ads: For a minimal investment per click, your business should strongly consider selectively targeting customers searching for you via Google and other search engines with brand messaging that supports going paperless.

- Social: Spread the word about eStatements through social posts, and take advantage of paid social ads to zero in on your followers with your messaging.

#5. Keep Things Familiar

Consumers have a status quo bias, making people more resistant to any kind of change. Try to disrupt as little as possible, keeping things as seamless as possible. If customers are considering converting to paperless, make sure that the statement or billing experience is consistent with the paper version.

Rather than create a drastically different look and feel to your eStatements, stay closer in design to your paper statements and invoices. If their information remains where it was—or within close proximity—on their paper statements, your customers should feel a sense of consistent brand experience as they transition to paperless statements.

#6. Make It The Default

Go all in and make eStatements and paperless billing the default format for new customers! People tend to make life easier on themselves by sticking with whatever the default option is.

Of course, if some customers prefer paper statements, you can provide them with the choice to opt in. Just be sure to make this paperless default policy very clear for new customers so they’re not caught off guard when they don’t receive a paper statement or invoice.

Next Steps

Regardless of where you are in the eStatement adoption process, the importance of communicating the benefits of going paperless is indisputable. Position the transition as a value add to your customers’ ease of use, as well as an environmentally beneficial change. Once you’ve effectively communicated the benefits of eStatements to new and existing customers, your business can increase its operational efficiencies.

Discover how to optimize your customer communications from design to delivery. Want to learn more? Let’s talk about how we can help you transition away from paper through our paperless eStatement solutions and customer communications to achieve more for your marketing – and your business.